This step is essential in full cycle accounting as it sets the stage for the rest of the accounting cycle. At the end of each accounting period, the balances on the accounts of the general ledger are listed to produce a trial balance. At this stage the total debits on the trial balance should equal the total credits. A trial balance is prepared to test the equality of the debits and credits. All account balances are extracted from the ledger and arranged in one report.

Step 9: Preparing the Post-Closing Trial Balance

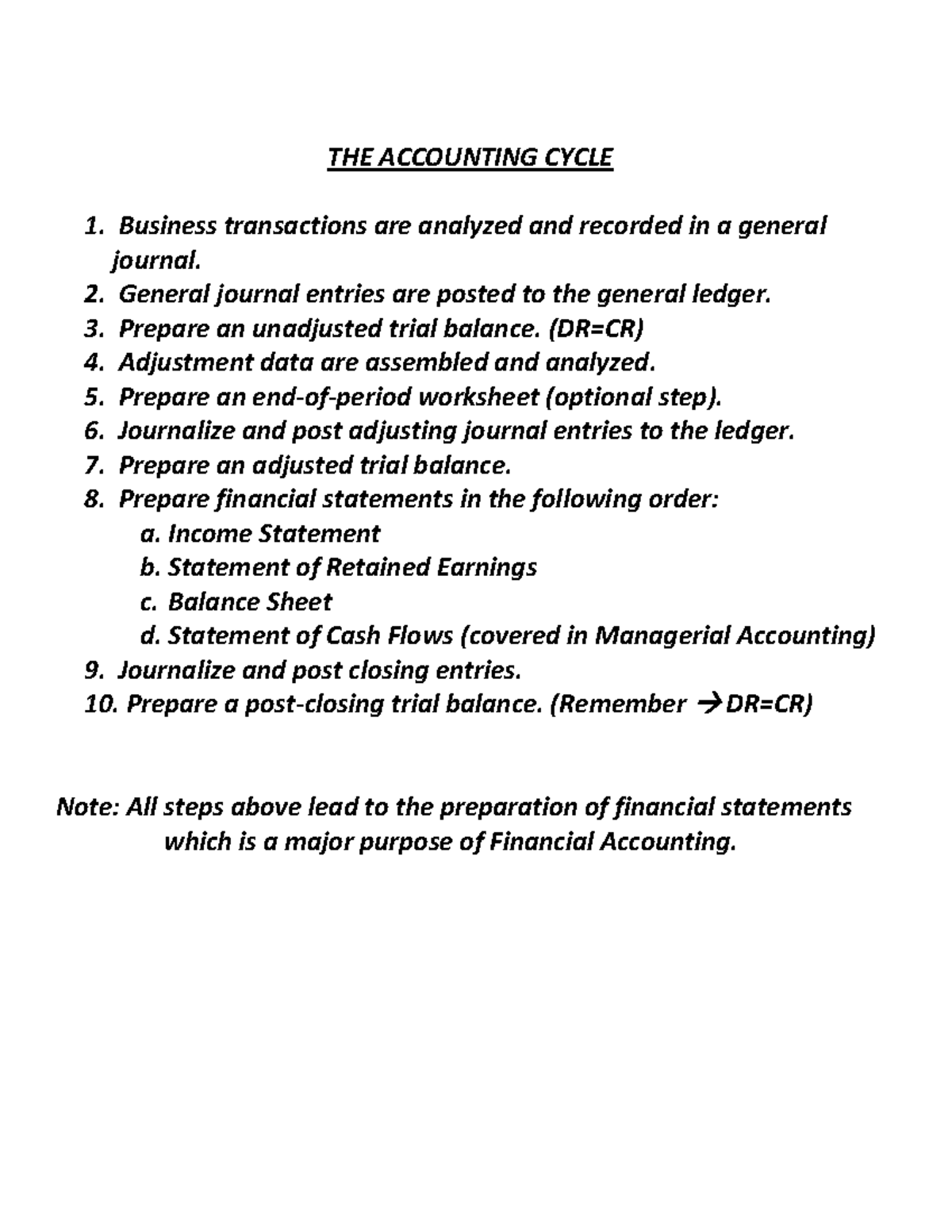

The dividend or withdrawal has its balance on Debit; thus, to close this account, we need to record on Credit and other correspondent entries to retained earnings. This step involves the transfer of all temporary accounts to retained earnings. In accounting, there are two types of accounts; Permanent Accounts and Temporary Accounts. Permanent accounts refer to all of the assets, liabilities as well as share capital or share premium. The fourth step of the accounting cycle is preparing the Unadjusted Trial Balance. The Unadjusted Trial Balance consists of the summary of each account balance.

What is the simple example of the accounting period concept?

Not all transactions and events are entered into the accounting system. It is crucial to maintain proper documentation supporting each transaction. This may include invoices, receipts, contracts, and any correspondence related to the transaction. Proper documentation not only facilitates the preparation of accurate financial statements but also aids in the audit process and compliance with regulatory requirements.

Step 3: Posting to the Ledger

These adjustments ensure that revenues are recorded in the period they are earned, and expenses are recognized when they are incurred. The accounting cycle is closely connected to the various accounting records maintained by a business. Each step in the accounting cycle contributes to the accuracy, organization, and usefulness of these records.

Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. The success of the accounting cycle heavily depends on having skilled accounting professionals. However, a shortage of talent and frequent staff turnover can disrupt the process. However, you can also outsource bookkeeper services for consistent expertise and a smooth, accurate accounting cycle. They typically happen once a year, and the business’s CPA can guide you through these if you’re not familiar with tax-related entries. As well as any other source documents of basic transactional information to be translated into valuable financial data.

Post-Closing Trial Balance

The accounting process is a combination of activities that begin when a transaction occurs and end with its inclusion in the financial statements at the end of the accounting period. Is keeping up with the accounting cycle taking up too much of your time? With Bench, you get access to your own expert bookkeeper to collaborate with as you grow your business. Our secure bank connections automatically import all of your transactions for up-to-date financial reporting without lifting a finger. Book review calls or send messages to get prompt answers to your questions so your financial health is never a mystery.

Closing entries offset all of the balances in your revenue and expense accounts. You offset the balances using something called “retained earnings.” Essentially, this is the profit or loss for the year that is “retained” in your business. Once you’ve posted all of your adjusting entries, it’s time to create another trial balance, this time taking into account all of the adjusting entries you’ve made. Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date. Through the accounting cycle (sometimes called the “bookkeeping cycle” or “accounting process”).

Closing the books at the end of an accounting cycle involves closing temporary accounts, such as revenues, expenses, and dividends (or withdrawal) accounts. These accounts are referred to as temporary because 10 steps of the accounting cycle their balances are reset to zero at the end of each cycle. This is crucial to provide accurate financial statements and ensure that the company’s accounts accurately reflect its financial position.

- Or, if you receive a payment, your sales revenue is credited while your bank account is debited.

- Through the accounting cycle (sometimes called the “bookkeeping cycle” or “accounting process”).

- If you use accounting software, this usually means you’ve made a mistake inputting information into the system.

- Normally, the increase comes from additional investment or injection of capital.

Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year. Therefore, the adjusting journal entries are prepared in order to recognize expenses and revenues that were incurred or earned but have not been recognized in the accounting book. Each accountant or bookkeeper shall understand the key principle of Debits (left-hand side) and Credits (right-hand side) when they analyze transactions.