The alternative is a mutual fund, the aforementioned exchange-traded fund or an index fund. These hold a basket of investments, so you’re automatically diversified. An S&P 500 index fund, for example, would aim to mirror the performance of the S&P 500 by investing in the 500 companies in that index. Though experience is a fine teacher, don’t forget about additional education as you proceed on your trading career. Whether online or in-person, classes can be beneficial, and you can find them at levels ranging from novice (with advice on how to analyze the aforementioned analytic charts, for example) to pro.

Block Trading May be Multiplier for Brazilian Equity Market – Markets Media

Block Trading May be Multiplier for Brazilian Equity Market.

Posted: Mon, 11 Sep 2023 17:22:57 GMT [source]

This must be deposited into the client’s account prior to any day-trading activities and maintained at all times. The good news is that the average bull market far outlasts the average bear market, which is why over the long term you can grow your money by investing in stocks. But investors who like a little more action engage in stock trading. Stock trading involves buying and selling stocks frequently in an attempt to time the market. If, on the other hand, you want to learn how to trade stocks, you do need to understand the stock market, and at least some basic information about how stock trading works. Phrases such as “earnings movers” and “intraday highs” don’t mean much to the average investor, and in many cases, they shouldn’t.

But unlike day trading, you aren’t limiting yourself to an instant turnaround, and you’re less likely to be impacted by a single bad day—or even a handful of bad days. By letting you wait days or weeks, swing trading gives you (and your investments) more time to realize a potential profit. Trading is buying and selling investments, such as stocks, bonds, commodities, and other types of assets, with the goal of making a profit.

More specialized seminars—often conducted by a professional trader—can provide valuable insight into the overall market and specific investment strategies. Most focus on a specific type of asset, a particular aspect of the market, or a trading technique. Some may be academic, while others are more like workshops in which you actively take positions, test out entry and exit strategies, and engage in other exercises (often with a simulator).

Whether you’re a beginner or an advanced trader, our events and courses offer the opportunity to expand your knowledge and improve your trading skills. Depending on trading style, using ETFs, CFDs and the forex market may be wise. Different instruments can be used to hedge or take advantage of disconnects in price such as a currency pair moving without the corresponding ETF moving (or vice versa).

It’s also useful to get yourself a mentor—a hands-on coach to guide you, critique your technique, and offer advice. Many online trading schools offer mentoring as part of their continuing ed programs. “I thought that was hilarious,” she said, adding that she intends to use the home for charity and fundraising events.

World stocks

Your business should earn a reasonable return in a reasonable amount of time. If you expect to be a multi-millionaire by next Tuesday, you’re setting yourself up for failure. Hard research allows traders to understand the facts, like what the different economic reports mean. Focus and observation allow traders to sharpen their instincts and learn the nuances. To be successful, you must approach trading as a full or part-time business, not as a hobby or a job.

Mental fortitude is required to bounce back from the inevitable setbacks and bad trading days that will occur in every trader’s career. Trading acumen is another requisite trait for trading success, but that can be developed over the years through knowledge and experience. When up and running with real money, you need to address position and risk management. Each position carries a holding period and technical parameters that favor profit and loss targets, requiring your timely exit when reached. Rumor and speculation are risky trading propositions, particularly in the case of acquisitions, takeovers, and reorganizations.

The main lure of trading in the foreign exchange markets is that minimal investment is required. Accounts can often be opened for as little as $100 and will allow individuals to day trade global currencies, indexes, and commodities. With the forex market, the trader is actually exchanging one currency for another, possibly in an account denominated in yet another currency. For example, a person no longer needs to buy gold physically or even from a futures contract, they can simply buy an exchange-traded fund (ETF) to participate in the movement of gold prices.

Obviously, the merits of ISI as an investment have nothing to do with the day trader’s actions. Individual traders often manage other people’s money or simply trade with their own. Few have access to a trading desk, but they often have strong ties to a brokerage due to the large amounts they spend on commissions and access to other resources. Regardless of what technique a day trader uses, they’re usually looking to trade a stock that moves (a lot). The profit potential of day trading is an oft-debated topic on Wall Street. Internet day-trading scams have lured amateurs by promising enormous returns in a short period of time.

Case Study – Building Upon Legendary Joel Greenblatt’s (“The Little Book That Beats the Market”) Brilliance

Our blog covers stock market basics to advanced strategies, news & analysis. If you haven’t done so already, now is the time to start a daily journal that documents all of your trades, including the reasons for taking risks, as well as the holding periods and final profit or loss numbers. This diary of events and observations sets the foundation for a trading edge that will end your novice status and let you take money out of the market on a consistent basis. That said, the old investor’s adage “sell the news” needs to be qualified significantly for the astute trader. Thus, the trader is unlikely to buy stock in a speculative phase and hold it all the way to the actual announcement.

So, when do you make the switch and start trading with real money? There’s no perfect answer because simulated trading carries a flaw that’s likely to show up whenever you start to trade for real, even if your paper results look perfect. “Businesses experienced severe shortages over the last few years. So, they tell me they are holding on to workers and investing in safety stock,” Thomas Barkin, the president of the Federal Reserve Bank of Richmond, said in a speech a month ago. But if there’s an extended period of slow demand, employers may give up and shed their “safety stock” in large numbers. In fact, there are already some signs of cracking in the labor market.

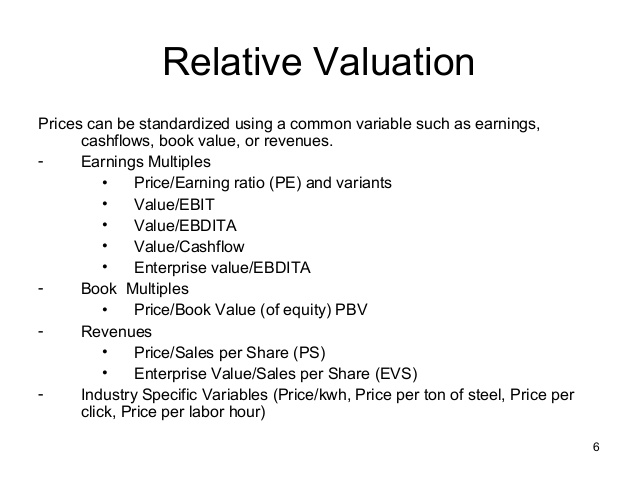

Forex trends tend to be the same in their volatility and price action whether the trend is up or down. The main reason is because it’s one currency against another in any given currency pair and this results in more balanced price movement. We’ve all heard the saying “The trend is your friend”, and while it sounds nice it doesn’t really teach us anything about trading a trending market or how to identify one. In today’s lesson, I am going to give you guys some solid information on trend trading that you can begin using immediately. Today’s lesson is all about trading trending markets with price action, and we are going to talk about how to tell when a market is trending and how to take advantage of these trends. Most equity investors are aware of the most common financial data used in the fundamental analysis including earnings per share (EPS), revenue, and cash flow.

That’s puzzling economists, who are used to seeing job offers disappear when growth slows. Last but not least, although excitement about the success of the Barbie movie has helped push Mattel stock higher, its recent gains don’t fully reflect the level of buzz the film generated. Shares are up 33% from March’s low, but still well below last year’s peak price, and even well below last year’s average price. Macroeconomic conditions and a muted mood are keeping investors tentative. Now, these retraces are when we have the highest potential for a high probability entry within the trend.

Keep in mind any additional trading requirements

Trading launches a journey that often winds up at a destination not anticipated at the starting line. Your broad and detailed market background will come in handy over and over again, even if you think you know exactly where you’re going right now. Whatever your belief system, the market is likely to reinforce that internal view again through profits and losses. Hard work and charisma both support financial success, but losers in other walks of life are likely to turn into losers in the trading game. Instead, take the self-help route and learn about the relationship between money and self-worth. World markets attract speculative capital like moths to a flame; most people throw money at securities without understanding why prices move higher or lower.

- Many professional money managers and financial advisors shy away from day trading.

- Setting realistic goals is an essential part of keeping trading in perspective.

- They refine these strategies until they produce consistent profits and limit their losses.

- World markets attract speculative capital like moths to a flame; most people throw money at securities without understanding why prices move higher or lower.

- As the saying goes, “Plan the trade and trade the plan.” Success is impossible without discipline.

By value, I mean from an optimum point in the market that has proved significant before. Swing trading

A slightly less hands-on sibling of day trading, swing trading is when you hold investments for days or weeks to capitalize on upticks—or swings—in the market. Like day trading, swing trading requires a lot of research and awareness of market and investment trends. You don’t, after all, want to miss the window to catch the swing and make a potentially profitable sale.

World stocks news flow

Before the end of the trading day, you usually sell everything off, with any profits (or losses) hitting your trading account. First off, the answer to that question should already be part of your trading plan in the form of a stop loss. As how long does it take to complete cfa a stop loss, you can use a financial stop, e.g., $500, or a technical stop price, such as if the 50-day moving average is broken, or new highs are made. The key is to remember that you always need a stop loss as part of your trading plan.

Take advantage of trends when they happen – There is never anything concrete with trends…meaning you never know how long they will last for, so try to take advantage of them when they do occur. Markets typically only trend about 25 to 35% of the time, and the rest of the time they are range-bound or chopping in a sideways fashion. The trick is to learn how to identify a trending market so that you can get the most out of it and get on board as early as possible. As you probably already know, there are tons of different indicators that you can put on your charts to ‘help’ you identify a trending market and trade with it. When a $20 stock splits 2-for-1, the company’s market capitalization does not change, but the company now has double the number of shares outstanding each at a $10 stock price.

AI-Powered Trading: Enhancing Performance with Machine Learning

A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. A day trade is exactly the same as any stock trade except that both the purchase of a stock and its sale occur within the same day, and sometimes within seconds of each other. Combined, these tools provide traders with an edge over the rest of the marketplace.

Markets News, Sept. 12, 2023: Stocks Fall on Apple’s iPhone 15 … – Investopedia

Markets News, Sept. 12, 2023: Stocks Fall on Apple’s iPhone 15 ….

Posted: Tue, 12 Sep 2023 21:04:00 GMT [source]

For example, say a day trader has completed a technical analysis of a company called Intuitive Sciences Inc. (ISI). The analysis indicates that this stock, which is listed in the Nasdaq 100, shows a pattern of rising in price by at least 0.6% on most of the days when the NASDAQ is up more than 0.4%. The trader has reason to believe that this is going to be one of those days.

The old adage “buy the rumor, sell the news,” applies to those trading in acquisitions, takeovers, and reorganizations. In these cases, a stock will often experience extreme price increases in the speculation phase leading up to the event and significant declines immediately after the event is announced. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Please assess your financial circumstances and risk tolerance before trading on margin. Margin credit is extended by National Financial Services, Member NYSE, SIPC.

Open a Trading Account

Our blog is designed to help you stay informed and make informed investment decisions, with stock picks, technical analysis, day trading tips, and stock market advice. Our blog is a hub for traders of all levels to stay up-to-date with the latest stock market news, analysis, and expert advice. Our blog covers a wide range of topics, from stock market basics to advanced trading strategies and the latest trends in Forex, indexes, crypto, stock, and commodities markets. Stay up-to-date with the latest stock market trends and news with our in-depth stock analysis and expert advice.

The trader is concerned with capturing some of the momenta in the speculative phase and may trade in and out of the same stock several times as the rumormongers go to work. The trader may hold a long position in the morning and short in the afternoon being ever watchful of charts and Level 2 data for signs of when to change position. Position traders may hold their position for many months or years. Because of the time required to research potential investments, follow changes and trends in the market, and implement all the trades you want, day trading can be as all-consuming as a full-time job. Day trading

When you day trade, you buy and sell stocks, ETFs, and other assets multiple times a day.

- But without a deep understanding of the market and its unique risks, charts can be deceiving.

- To sum up, the job market still appears pretty healthy, even tight.

- Most of them rate the stock a strong buy, based on the pending benefit of the Barbie movie in addition to the other toy-based films Mattel has in the works, and their consensus target price on it is $24.50.

- As a stop loss, you can use a financial stop, e.g., $500, or a technical stop price, such as if the 50-day moving average is broken, or new highs are made.

- When the stock market declines, it can be difficult to watch your portfolio’s value shrink in real time and do nothing about it.

- Stocks are listed on a specific exchange, which brings buyers and sellers together and acts as a market for the shares of those stocks.

To sum up, the job market still appears pretty healthy, even tight. But the Fed shouldn’t take that as a justification for ratcheting interest rates even higher. And second, in this era of slow labor-force growth, the cost to the economy of further https://1investing.in/ weakening workers’ bargaining power to slow wage growth is unacceptably high. In comparison the job market has been, as I said, relatively strong. On Friday the Bureau of Labor Statistics reported that payrolls grew by 187,000 jobs in August.

In July, Moody’s economists led by Thomas P LaSalvia and Nick Villa forecasted that as many as 5 million student loan borrowers will need to resume payments close to $275 per month on average. Millions of student loan borrowers have enjoyed the pause in payments since March 2020, but the end of that moratorium will deliver a “major financial shock” to young adults, according to Moody’s Analytics. The 10-year yield settled at 4.263$, down from 4.287% late yesterday.