ATL deductions lower AGI, which means less income to pay taxes on. They include expenses that are claimed on Schedules C, D, E, and F, and “Adjustments to Income.” One advantage of ATL deductions is that they are allowed under the alternative minimum tax. ATL deductions have no effect on the BTL decision of whether to take the standard deduction or to itemize instead. Please consult the official IRS website for more detailed information regarding precise calculations of tax deductions. They help lower tax bills by reducing the percentage of adjusted gross income that is subject to taxes. There are two types of deductions, above-the-line (ATL) and below-the-line (BTL) itemized deductions, which reduce tax based on the marginal tax rate.

What’s the difference between a deduction and withholding?

Our staff of nearly 200 employees, most of whom serve in their own local churches, are just as diverse in their beliefs and affiliations as our customer base is. We take great pride in the work we do, and the way it impacts the greater Church as a whole. With Tithe.ly you can create as many tax tips for resident and non 2020 funds / designations as you need (e.g. tithe, offering, missions, building fund, weekly contribution, annual campaign, etc.). These appear to your members / givers when they give, making it very simple for them to be sure their generosity goes to the place they are most passionate about.

- The ROTH and IRA Retirement saving calculator (Pension Contributions Comparison Calculator) allows you to compare how your money will work for you when using either of the pension schemes.

- While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary.

- We are also going to assume that you get two weeks of paid vacation per year.

- Most people that choose to itemize do so because the total of their itemized deductions is greater than the standard deduction; the higher the deduction, the lower the taxes paid.

- This calculation process can be complex, so PaycheckCity’s free calculators can do it for you!

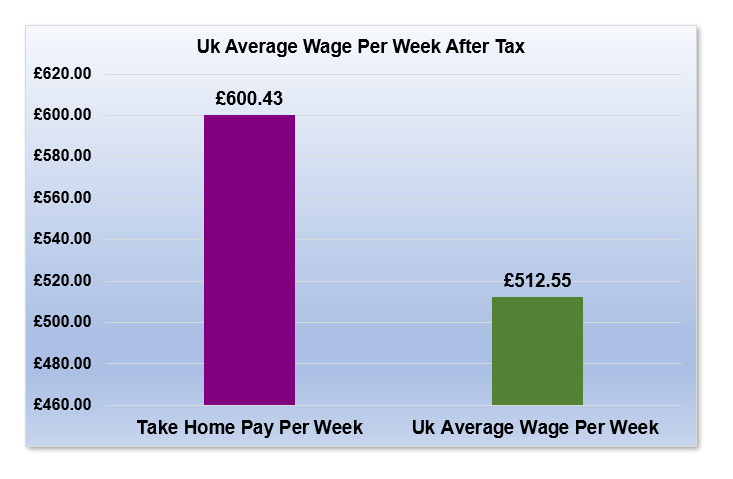

How much is your (gross) salary in £?

Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home. While there isn’t any one size that fits all when it comes to your tax withholdings, generally you can expect to have both FICA and federal income taxes withheld from your pay. Information you supply on your W-4—including your tax filing status (such as single or married filing jointly) and number of dependents—will help your employer calculate the proper withholding. Completing your W-4 form correctly can protect you from being hit with a tax penalty if too little is withheld throughout the year. The federal income tax rates differ from state income tax rates.

$435/mo for a church of 100

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250. Due to this, if allowed, non-exempt employees have the opportunity for a bigger paycheck by working over 40 hours per week. While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary.

$39,000 a Year Is How Much an Hour? Is It a Good Salary?

Your net pay is essentially your gross income minus the taxes and other deductions that are withheld from your earnings by your employer. Your net pay each pay period is the final amount on your paycheck. Your annual net pay is your salary minus the money that’s withheld throughout the year. For each payroll, federal income tax is calculated based on the answers provided on the W-4 and year to date income, which is then referenced to the tax tables in IRS Publication 15-T.

Paycheck Calculator

It’s essential to emphasize that our sponsorship does not imply alignment with the beliefs or positions held by the customers organizing the event. Tithely remains committed to a neutral stance and refrains from endorsing or promoting the ideologies of any organization with which it collaborates for marketing purposes. I am totally impressed with the results we’ve attained from Tithe.ly. Oh and I love that at the end of the year, the report for each person comes individually.

If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Tax deductions, on the other hand, reduce how much of your income is subject to taxes.

It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. The tax calculation provides an overview of Federal and State Tax payments for an individual with no children and no special circumstances.